Count Draghula

@countdraghula

Followers

19,470

Following

505

Media

1,168

Statuses

8,482

Macro trading is dead, because markets aren't allowed to find fair value.

Joined December 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Kroos

• 515310 Tweets

Reich

• 158682 Tweets

England

• 145381 Tweets

Apple Music

• 81430 Tweets

Boeing

• 78102 Tweets

Rashford

• 56388 Tweets

Singapore Airlines

• 52098 Tweets

招待コード

• 51372 Tweets

#KKRvsSRH

• 49294 Tweets

Modric

• 45645 Tweets

Southgate

• 38861 Tweets

ROCKSTAR PRINCE SUHO DAY

• 33949 Tweets

Klaus Schwab

• 33649 Tweets

كروس

• 31989 Tweets

Grealish

• 31301 Tweets

Poch

• 25839 Tweets

Iniesta

• 25212 Tweets

Vivian

• 22301 Tweets

Shaw

• 21193 Tweets

花帆ちゃん

• 21035 Tweets

Hellblade 2

• 20825 Tweets

Prat

• 15389 Tweets

Luna Park

• 15051 Tweets

25Mayısta KonferansaDavet

• 13066 Tweets

Shreyas Iyer

• 12520 Tweets

Denji

• 11506 Tweets

チェンソーマン

• 11297 Tweets

Last Seen Profiles

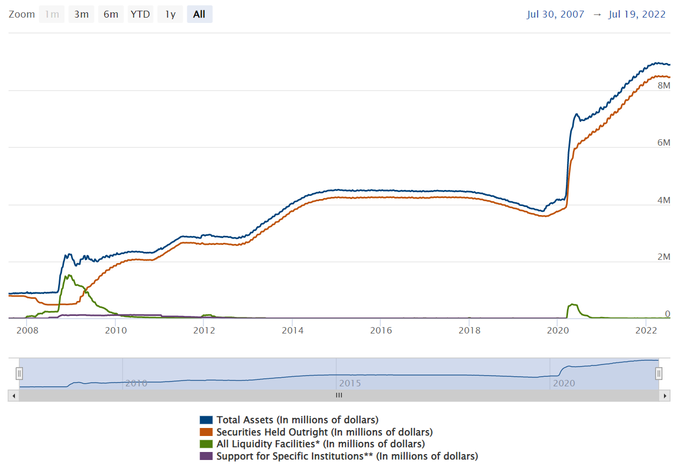

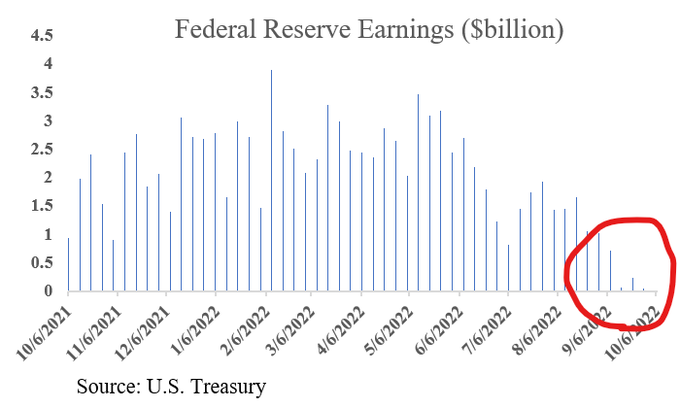

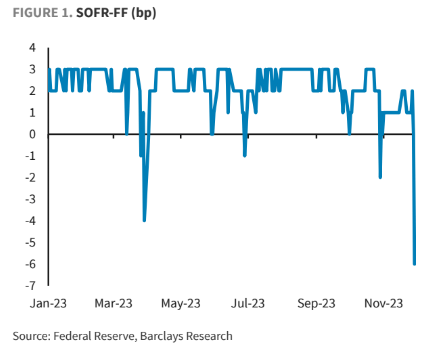

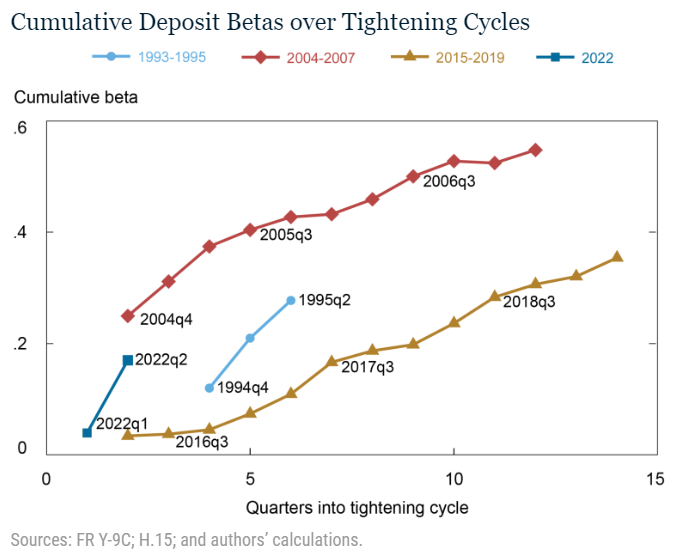

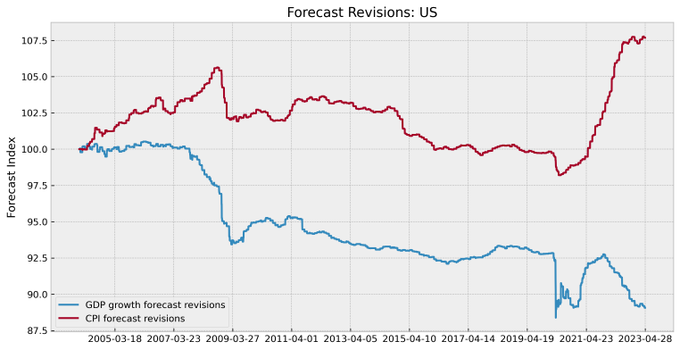

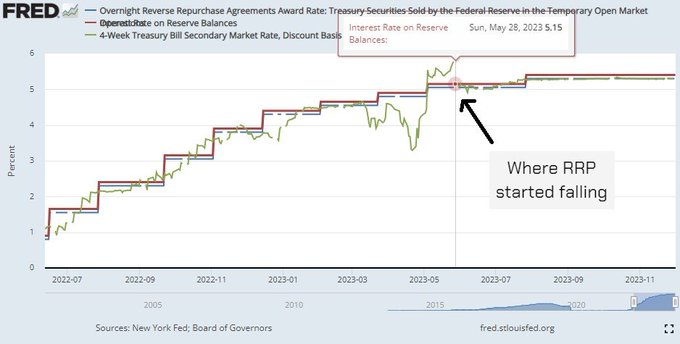

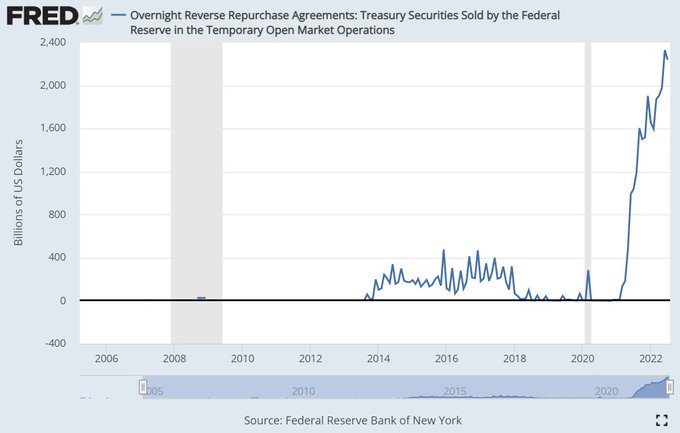

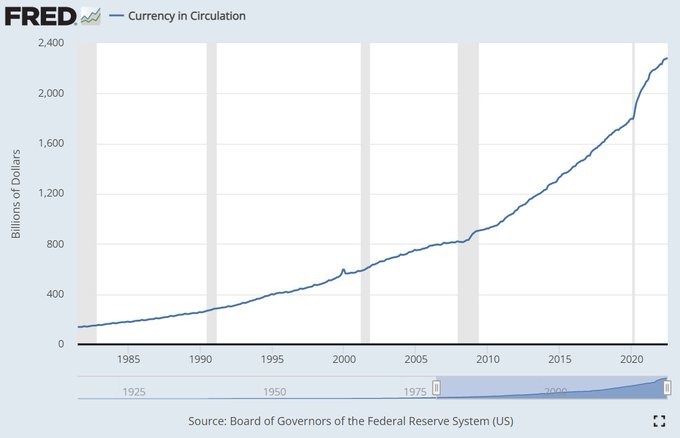

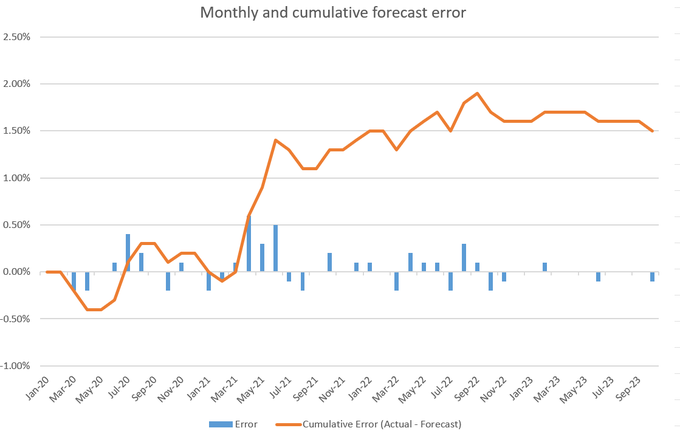

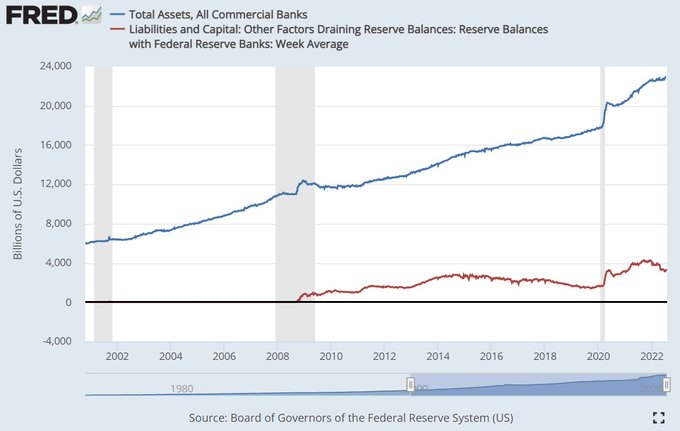

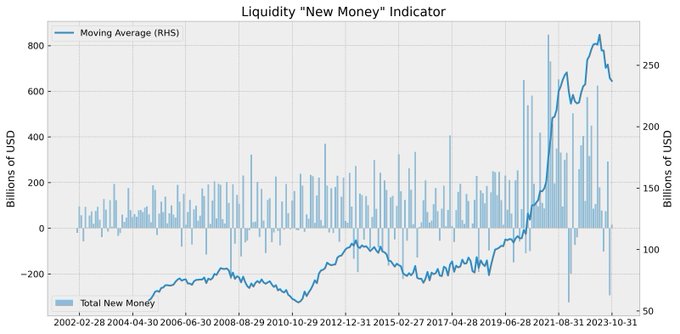

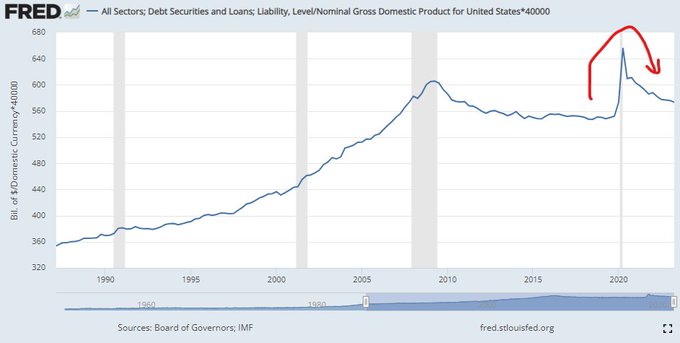

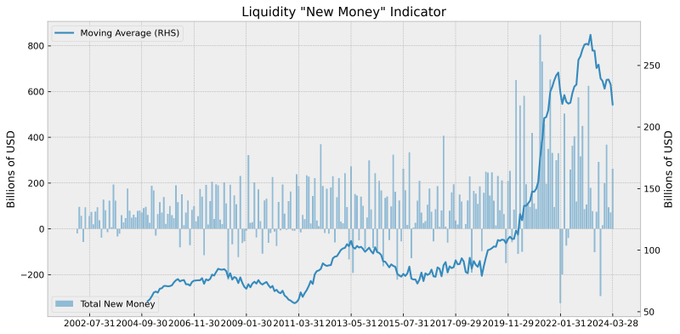

The Fed now earns less on its assets than it pays on liabilities.

It's a problem, and the only realistic way to fix this short-term is to slow down hikes.

If they don't fix it, we start "proper", unbacked, money printing.

1/

(chart

@FedGuy12

)

68

479

2K

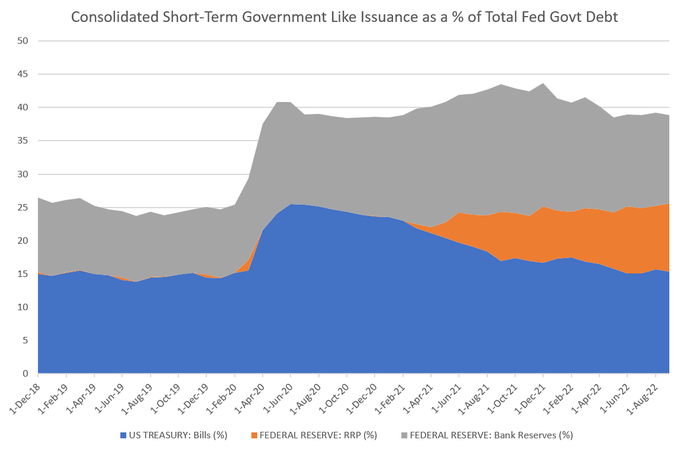

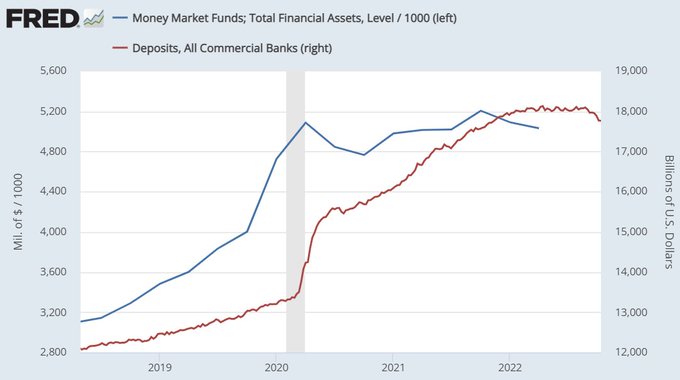

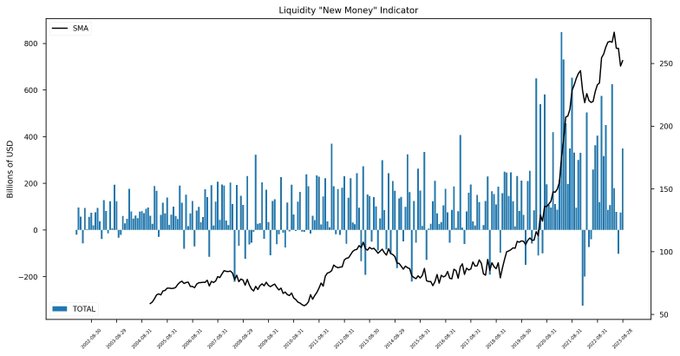

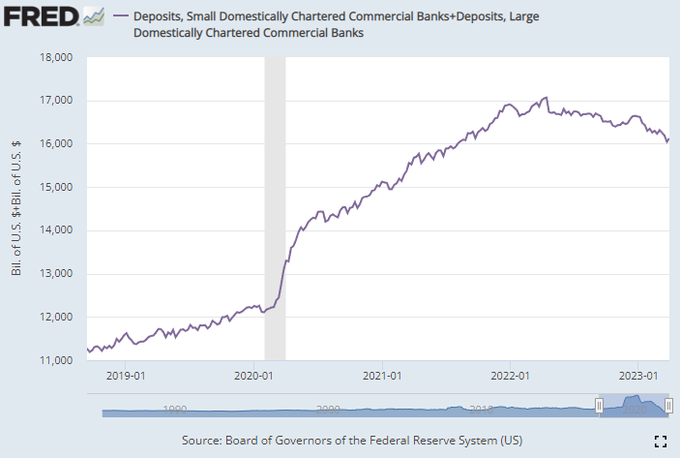

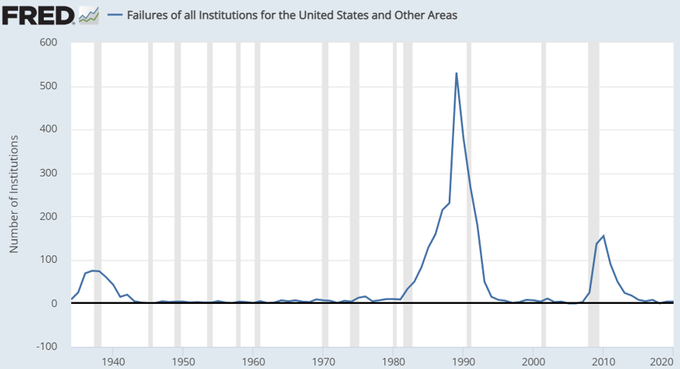

QE did NOT create deposits.

QE created an asset for the banks (reserves), not a liability, which is what a deposit is.

The banking sector created deposits when it funded the purchase of massive treasury issuance.

New government debt created the deposits.

1/

25

46

291

2/ How did this happen?

It was totally predictable, and no surprise.

The thread below is a primer on the Fed balance sheet, and worth reading first.

The majority of the Fed's balance sheet is not from QE, but to satisfy demand for safe assets.

1

6

127

From the guy that wrote the book on it...

QE does NOT create real-world deposits. It creates non-fungible bank reserves.

The govt created deposits, along with the assets (UST) that the banks bought.

The only way these deposits 'disappear' is if the govt repays its debt.

1/

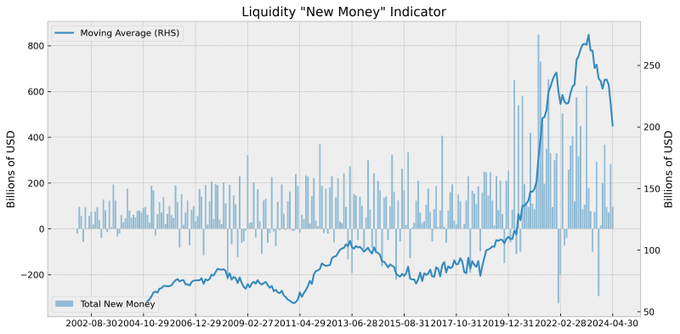

@jnordvig

@BobEUnlimited

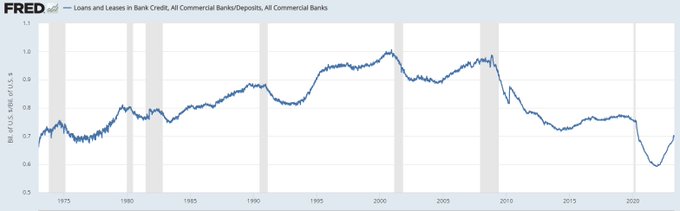

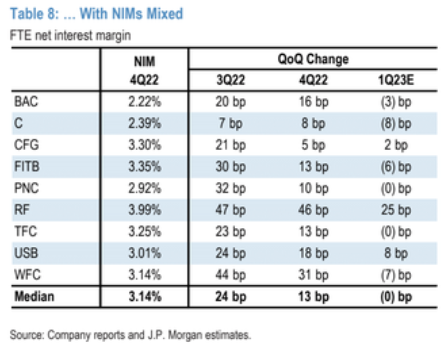

Also worth thinking about just how many deposits does a bank need? Structurally we are coming out of a period of ginormous QE, so loan/deposit rations are very low.

There are compositional issues ofc, but even small banks are at levels prevailing before 2020.

4

5

29

13

22

131

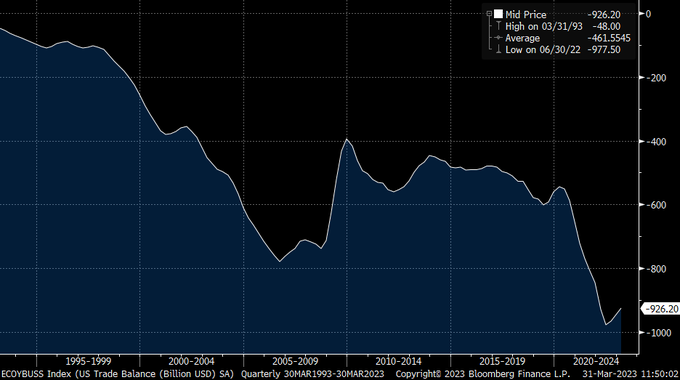

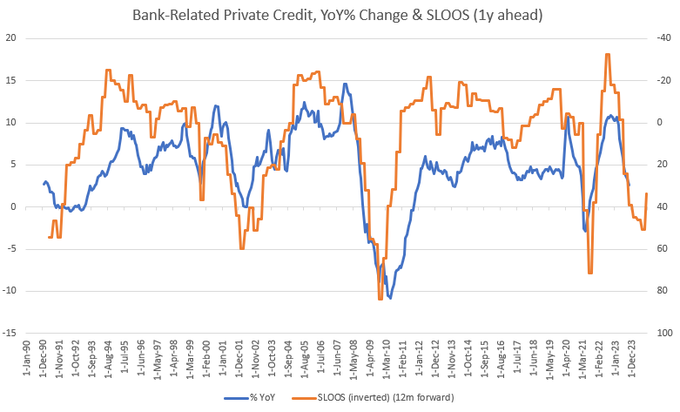

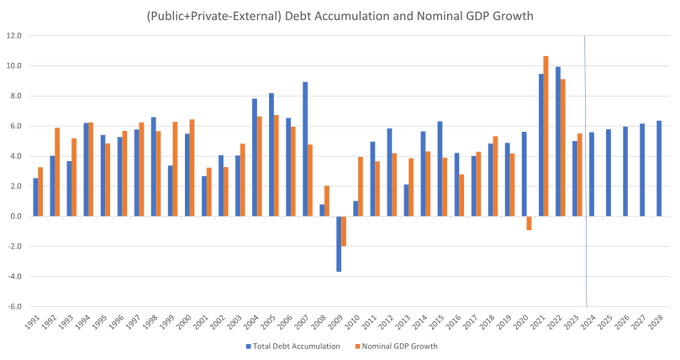

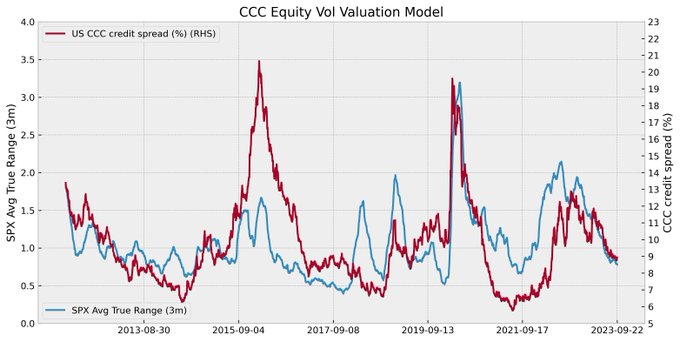

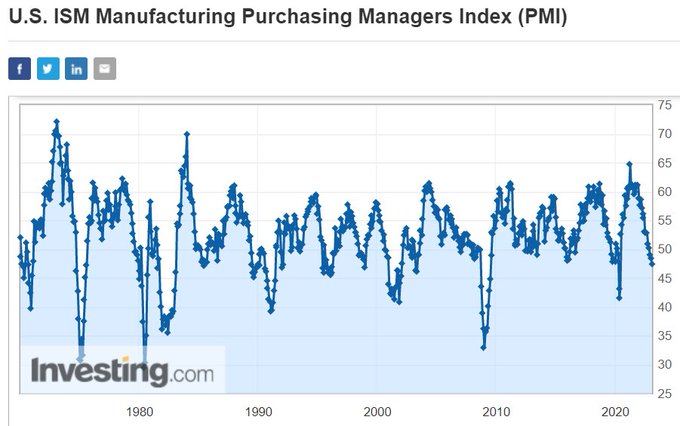

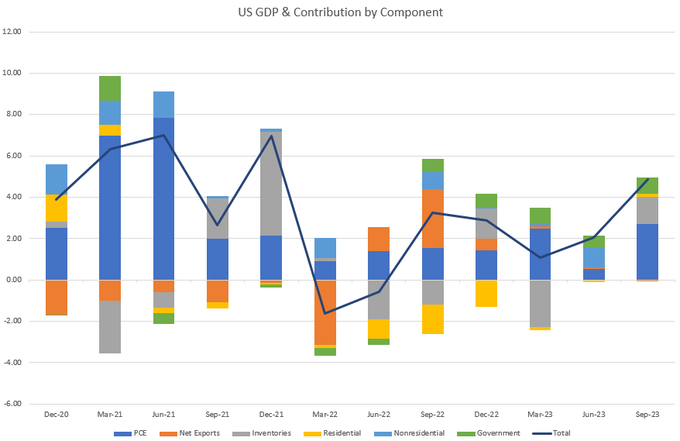

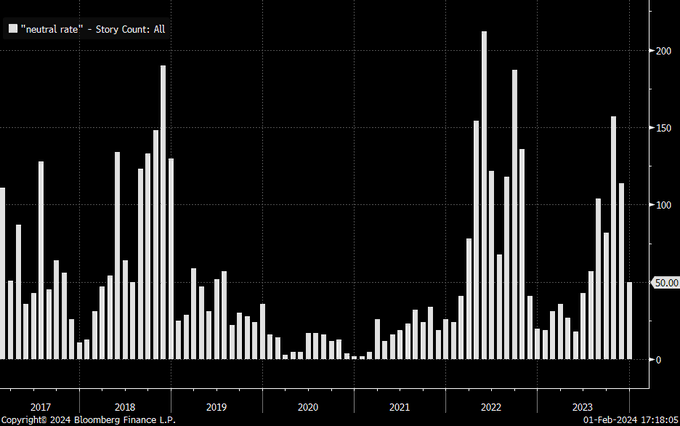

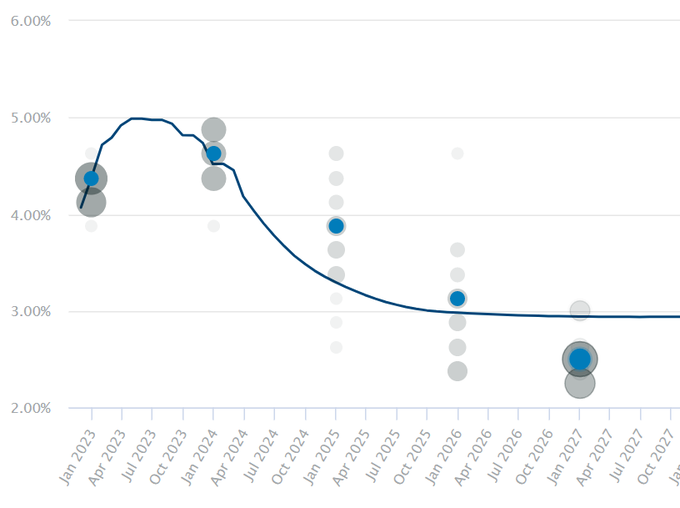

I'm sticking my neck out here, but here goes...

I really struggle with the idea of R* in an economy an economy where increasing debt delivers less and less NGDP per $. An economy that has almost 0% total factor productivity. R* doesn't matter here, so it becomes impossible to

7

12

103