Steve Deppe, CMT

@SJD10304

Followers

16,357

Following

1,640

Media

7,385

Statuses

98,425

CIO at NDWM, Charts & Sheets lover, Sports Fanatic, *my tweets are not investment advice*

San Diego

Joined January 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

キスの日

• 269883 Tweets

Bronx

• 141545 Tweets

Taiwan

• 116042 Tweets

hoshi

• 90932 Tweets

INCOMPARABLE WINNER ELVISH

• 63787 Tweets

Kano

• 55776 Tweets

DILAW OUT NOW

• 36718 Tweets

Ticketmaster

• 32408 Tweets

LAYOVER DOMINATION

• 31001 Tweets

HBD YTSTAR ABHISHEK MALHAN

• 27974 Tweets

CONGRATULATIONS TAEHYUNG

• 27565 Tweets

Live Nation

• 26658 Tweets

Beetlejuice Beetlejuice

• 26530 Tweets

FELIX LOUIS VUITTON CRUISE

• 24615 Tweets

CSK BAAP OF RCB

• 23837 Tweets

NEWJEANS IS BACK

• 23509 Tweets

은호야 생일

• 19355 Tweets

FELIX ENAMORA A BARCELONA

• 16559 Tweets

Wanda

• 16290 Tweets

$Retik

• 15634 Tweets

$BEER

• 14795 Tweets

Paquetá

• 14697 Tweets

Claudio Iturra

• 12636 Tweets

Zverev

• 12274 Tweets

SummerSlam

• 12064 Tweets

Last Seen Profiles

@getnickwright

You gotta own this one Nick, the reason they’re down 0-2 is because LBJ and AD we’re atrocious tonight.

It’s ok to say it.

32

12

847

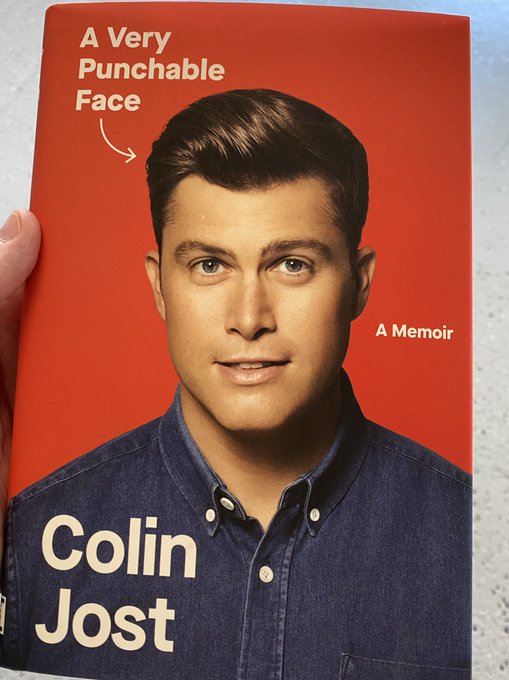

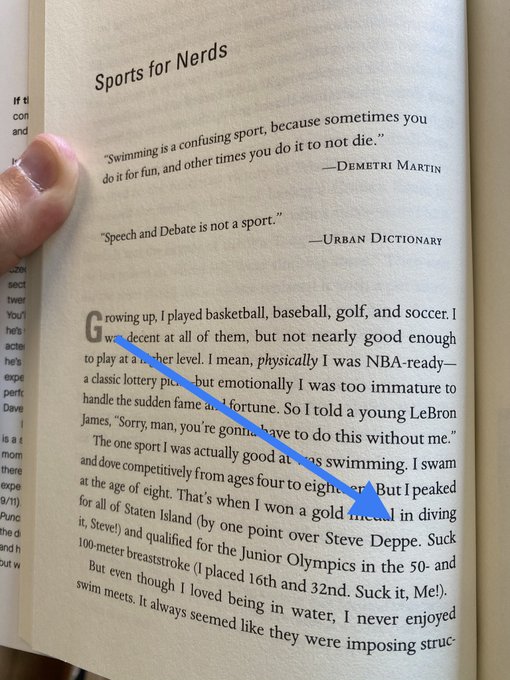

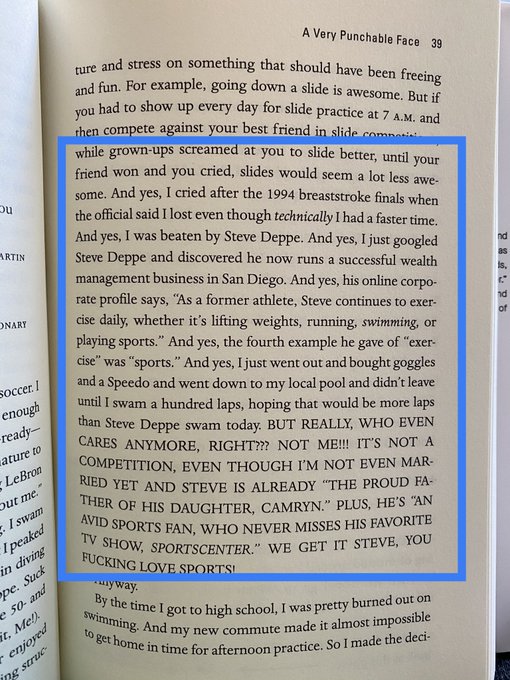

Got my copy of

@ColinJost

new book today.

Why?

Because he tells me to “Suck it, Steve!” on page 38 - but - then tells a cool story about us on page 39.

I think this is a top 3 highlight of my quarantine.

28

8

284

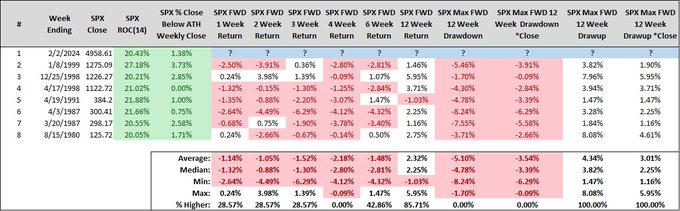

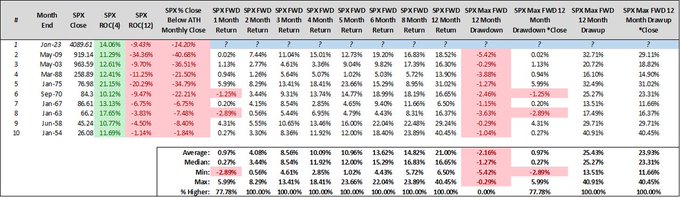

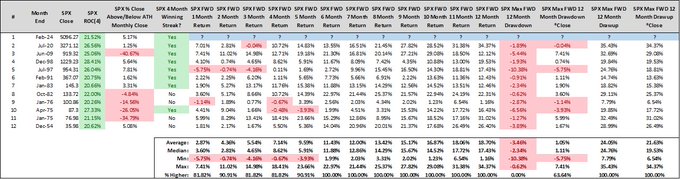

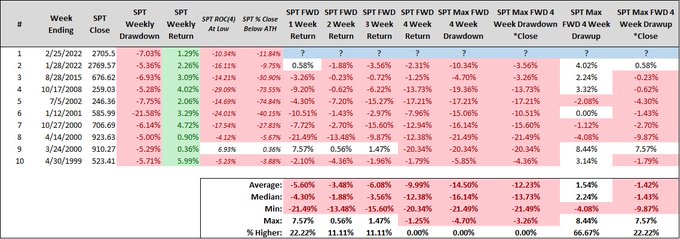

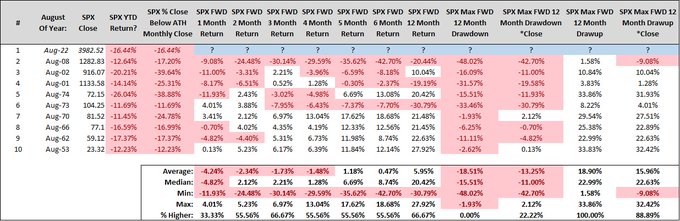

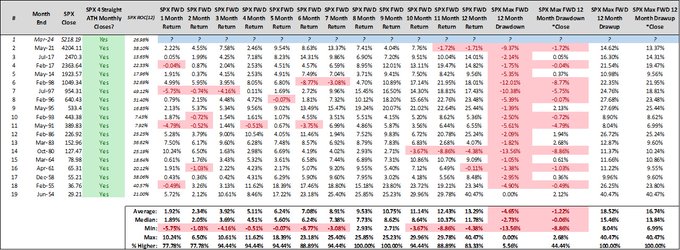

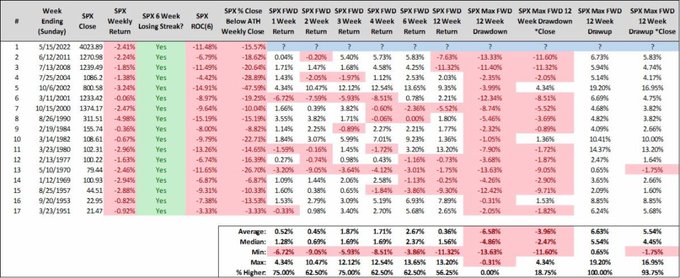

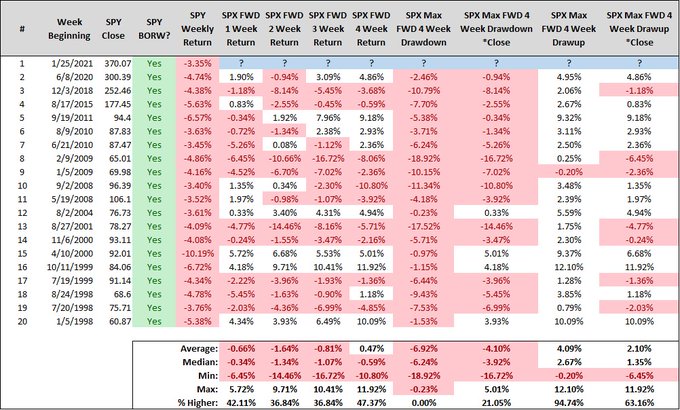

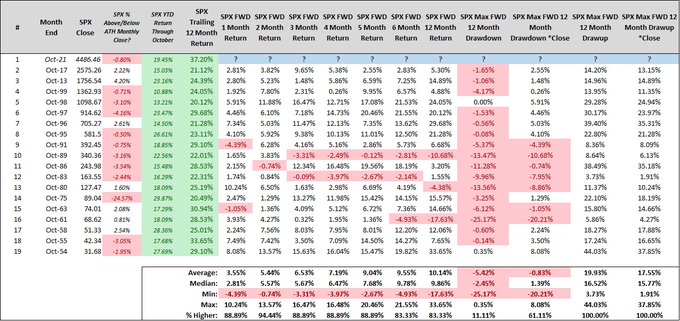

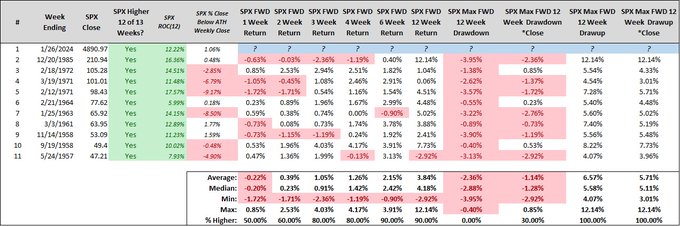

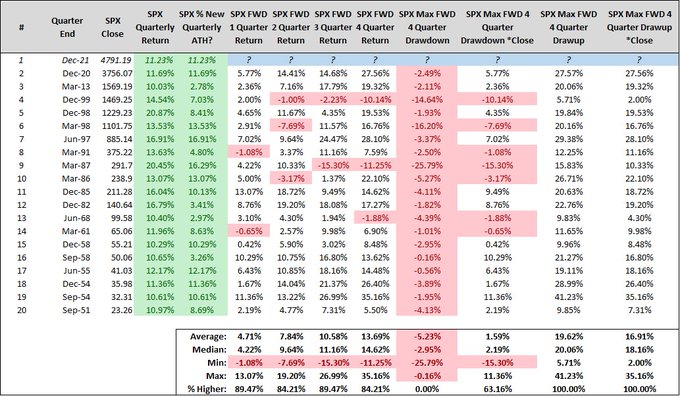

When is the last time the S&P 500 gained 4%+ in a week while closing within -10% of its ATH weekly close after having declined -5% or worse the trailing 12 weeks?

Week ending 11/30/2018.

Read

@hmeisler

pinned tweet & don't fall victim to overconfidence.

Stay disciplined!

30

25

268

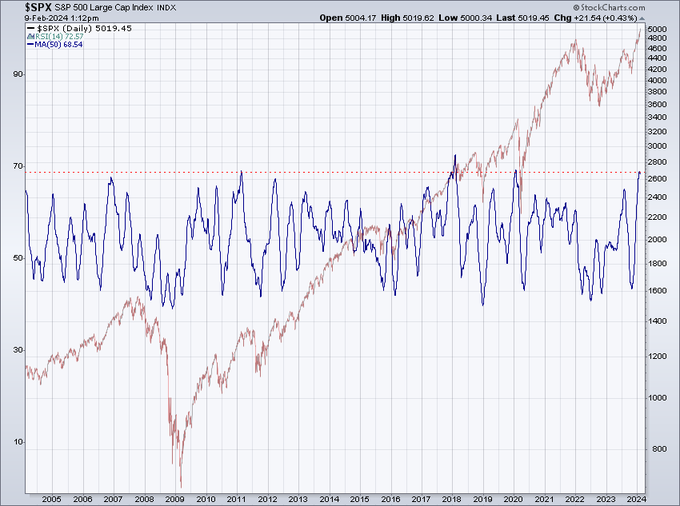

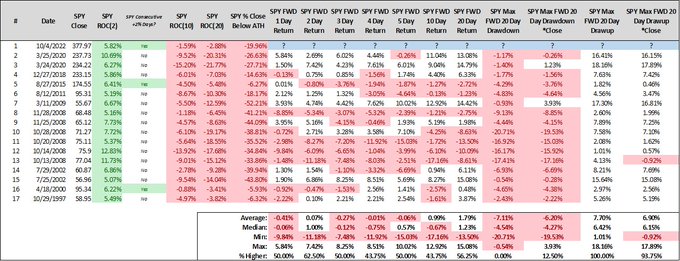

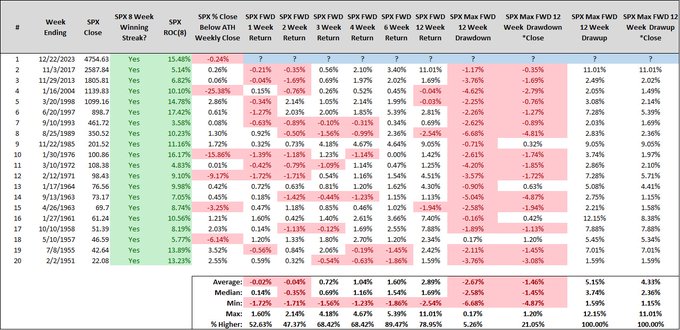

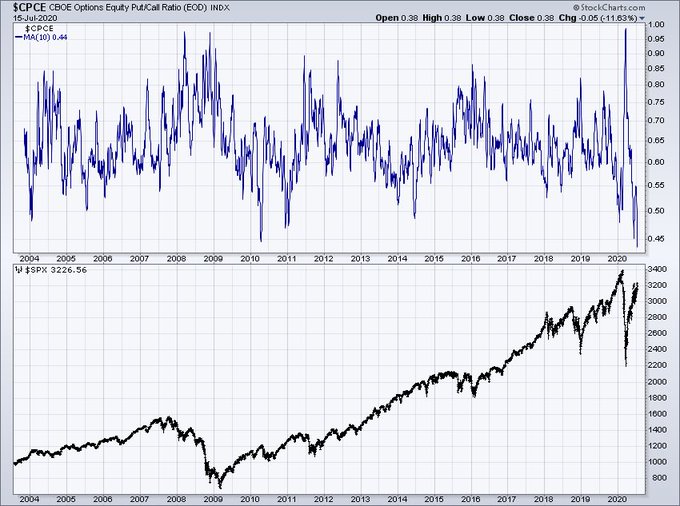

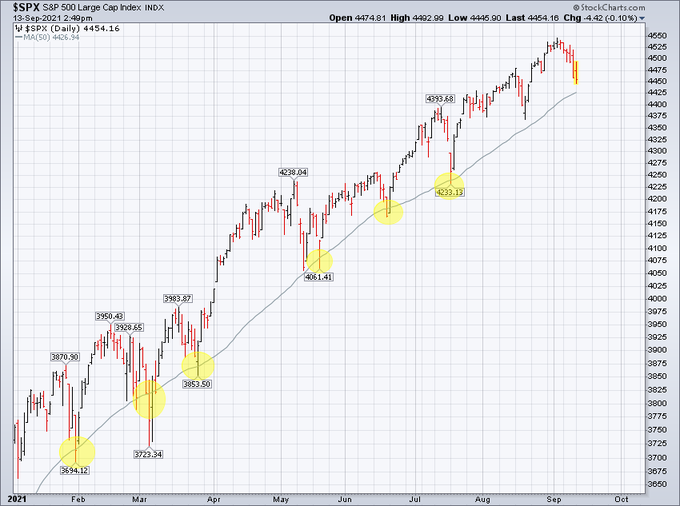

50 day SMA of RSI(14) on the daily for $SPX is knocking on the door of 70.

This hasn't happened often the last decade plus and prices don't move linearly forever guys.

#SPX

cc:

@MacroCharts

14

31

183

@getnickwright

Old guy *half.

He isn’t doing much of anything in this 2nd half (offensively) and that’s why the broadcast is correct in their assessment.

Take the ball, Lebron. It’s simple.

10

3

161

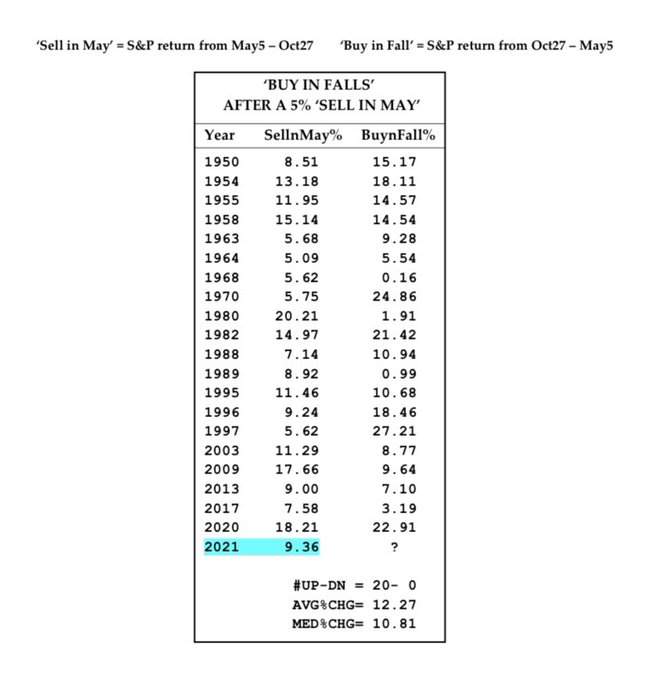

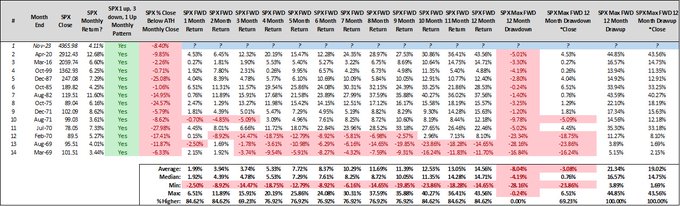

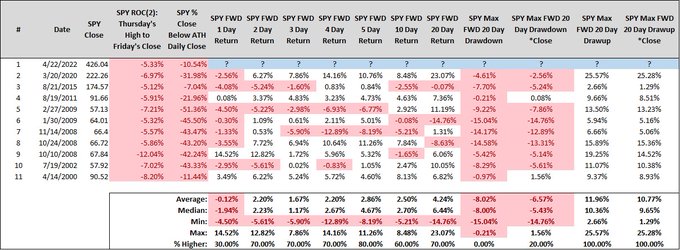

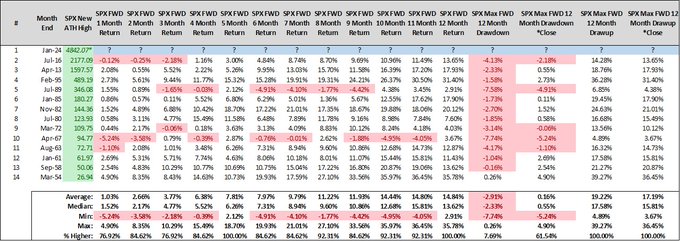

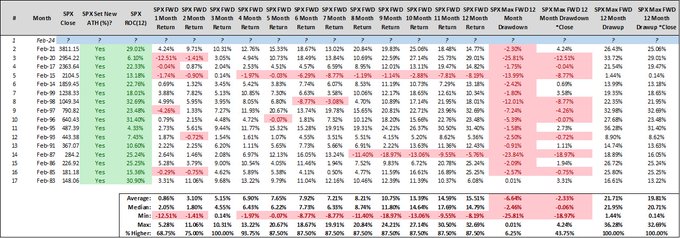

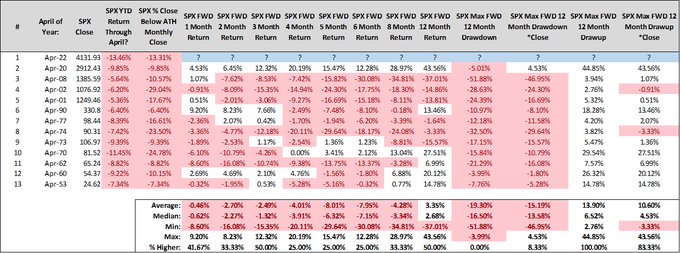

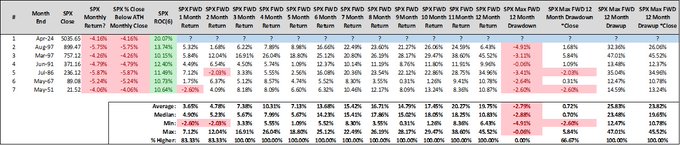

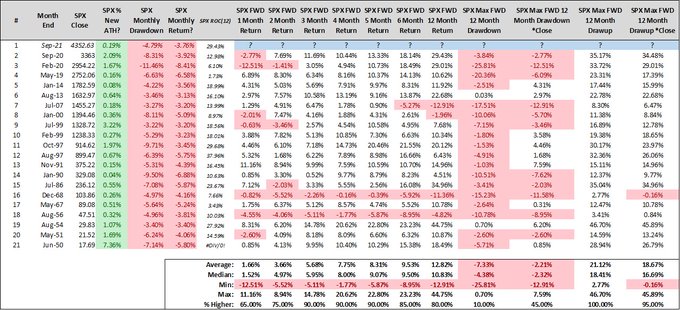

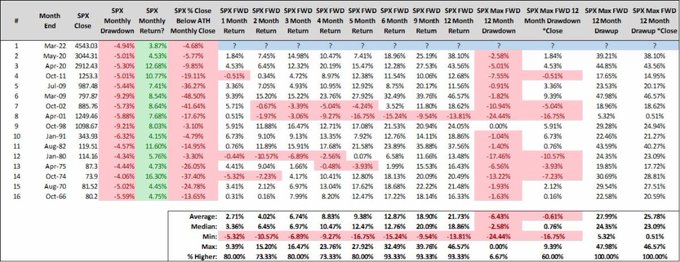

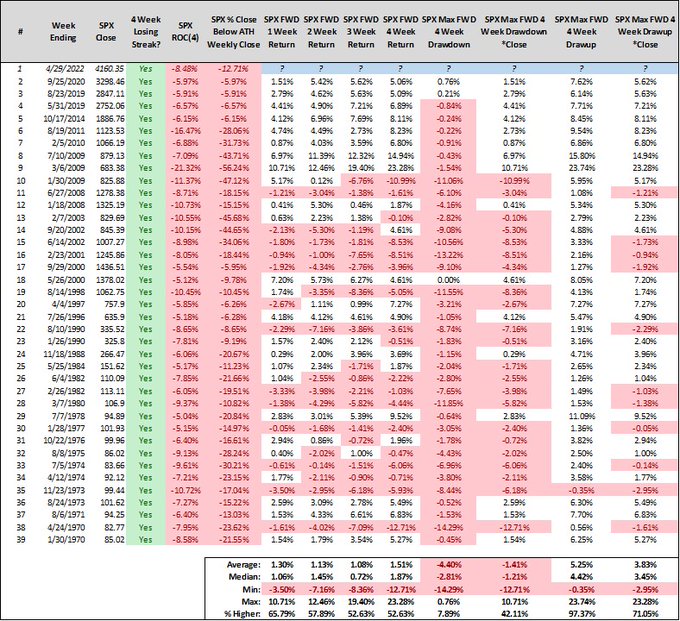

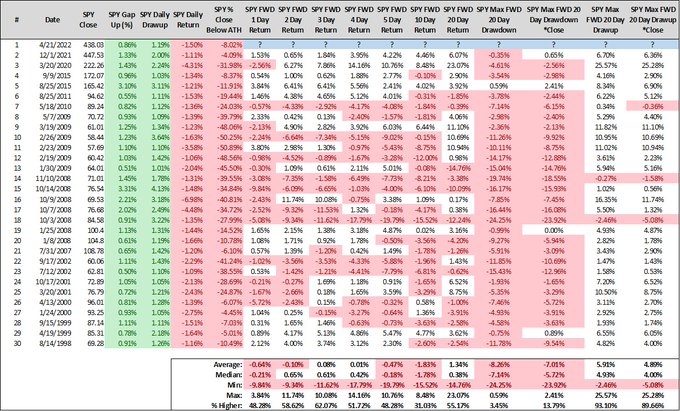

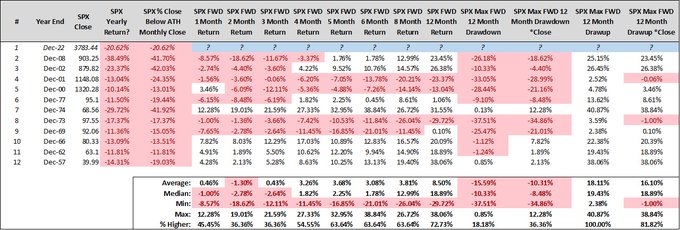

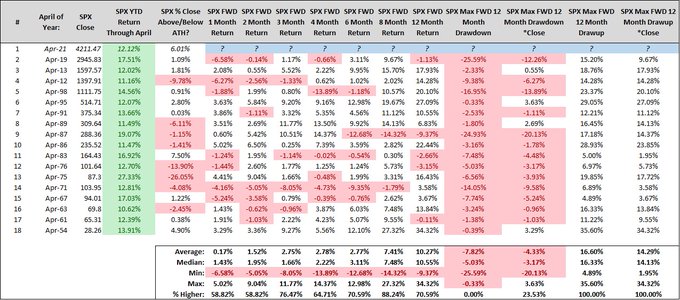

Here is what the rest of the year has looked like when the S&P 500 ends the month of April down -5% or worse on the YTD scorecard.

I suppose the question is:

Can the

@federalreserve

can do it again?

Are you feeling lucky?

15

39

144

@arielhelwani

Excessive worry over fingers - no worry over 294 punches unanswered.

This guy should never ref a fight again in his life.

#UFC251

1

1

80